Posted: April 19, 2013

From Offshoretechnology.com 19/04/2013

“Europa has signed a farm-in agreement with a subsidiary of Kosmos Energy to acquire its two Licencing Options, LO 11/7 and LO 11/8, in the South Porcupine Basin, offshore of Ireland.

As part of the deal, Kosmos will buy an 85% interest and take up the operatorship of both licences, alongside incurring 100% of the costs of the first exploration well on each block.

The company will also fully fund the cost of a 3D seismic programme on each licence and pay 85% of the costs incurred by Europa to date.

The first exploration wells on LO 11/7 and LO 11/8 have investment caps of $90m and $110m, respectively, while Kosmos will share 85% of the excess costs of the investment cap, with the remaining coming from Europa.

Both LO 11/7 and LO 11/8 cover an area of about 1,000km² each in the prospective South Porcupine basin, while the licences have been mapped using existing 2D seismic data and are currently undrilled.

“The company will also fully fund the cost of a 3D seismic programme on each licence and pay 85% of the costs incurred by Europa.”

Europa has identified two previously unknown prospects in the Lower Cretaceous stratigraphic play – Mullen in LO 11/7 and Kiernan in LO 11/8.

Europa CEO, Hugh Mackay, said Kosmos is an experienced operator in frontier basins and pioneered the Cretaceous stratigraphic play that lead to a major exploration success in the Atlantic margin basins.

“The farm-in provides recognition of the substantial potential value lying in our Irish exploration prospects. The work programme associated with the farm-in has the potential to deliver significant value realisation,” Mackay added.

“Europa’s retained 15% interest exposes the company to substantial upside in the event of drilling success at either or both of these prospects at a much reduced risk and cost to our shareholders.

“We understand that the Eirik Raude rig is in Irish waters to drill Exxon‘s Dunquin well. An exciting new chapter in the exploration of Ireland is starting and we are delighted to be part of it.”

The closing of the farm-in agreement is subject to approval from the Irish Government.”

http://www.offshore-technology.com/news/newseuropa-exploration-south-porcupine-basin-ireland?WT.mc_id=DN_News

Sign Up to our Newsletter

Click Here

Posted: April 4, 2013

Tuesday 04/04/2013

“AN EXPLORATION COMPANY with rights to explore an area off the west coast of Co Kerry claims the field has shown the potential to hold hundreds of millions of barrels worth of oil.

Petrel Resources says the site in ‘Quad 45′, about 100 kilometres to the west of Valentia Island, has “the capability to hold several hundred million barrels of in-place oil”.

The site was authorised for exploration in 2011, when 13 various sites in the Porcupine Basin off the west coast were offered for new ventures.

Petrel was offered two of those sites; the other site in ‘Quad 35′, about 120 kilometres west of the Dingle peninsula, showed the capability of hosting in excess of a billion barrels of oil.

Quad 45 lies about 35 kilometres northeast of an area in the Dunquin prospect, which is already the focus of a major prospective drilling operation from a consortium led by Exxon Mobil.

Petrel said it had purchased additional seismic data of the area and has carried out further regional seismic mapping.

“We have long believed that the offshore Porcupine Basin is a hydrocarbon province,” Petrel managing director David Horgan said in a media release.

“This has been further supported by our recent work in identifying potential prospects on both of our blocks.

“We look forward to increased activities across the Basin which we believe has the potential to be a major new oil province. We have commenced our search for potential partners.”

Shares in Petrel rose by over 10 per cent in early trading in London this morning.”

Extract from thejournal.ie

http://businessetc.thejournal.ie/oil-porcupine-basin-kerry-petrel-853171-Apr2013/

Sign Up to our Newsletter

Click Here

Posted: April 2, 2013

Extract from Independent.ie Tuesday April 2nd

By John Mulligan

“Oil giant ExxonMobil kicks off a $160m-plus (€125m) drilling programme off the west coast of Ireland this weekend with hopes that confirmation of major fossil fuel reserves will transform the country’s economy.

The US company is planning to drill test wells over a four-month period at two prospects at the Dunquin licence area in the Porcupine Basin, 200km off shore.

Previous data has suggested that there could be over 300 million barrels of oil and 8.5 trillion cubic feet of gas between the two Dunquin prospects.

If they could be proven and then extracted, such finds would mark one of the biggest ever global discoveries of oil and gas and be a game-changer for Ireland’s economic fortunes.

Hidden

But despite the 200 or so wells drilled off Ireland’s shores in the past number of decades, only two have resulted in commercial fields – Kinsale and Corrib.

Both are minnows compared to the prospective resources that could be hidden at Dunquin. Kinsale had about 1.5 trillion cubic feet of gas, while Corrib has about one trillion.

Located at a point in the Atlantic where the ocean is 1.6km deep, ExxonMobil’s drilling programme is being eagerly watched by oil companies from abroad and Ireland, including Petrel Resources, which has an exploration block just 35km away from the Dunquin prospect.

ExxonMobil controls 27.5pc of the Dunquin prospect, with Italian firm Eni holding another 27.5pc.

Spanish energy firm Repsol owns 25pc and UK-based Sosina has a 4pc interest. Irish exploration firm Providence Resources has a 16pc interest in the prospect. A major oil or gas find could catapult its shares higher.

The Dunquin prospect – where the reserves are as deep as 3.6km under the seabed – is one of the most important exploration areas for Providence, which is headed by Tony O’Reilly Jnr.

Providence is also betting that it could have a major oil find on its hands at a site called Barryroe, which is close to the Kinsale field. The company reckons that there could be 280 million barrels of recoverable oil at the Barryroe prospect.”

http://www.independent.ie/business/irish/oil-giant-exxon-starts-160m-drilling-project-off-west-coast-29163728.html

Sign Up to our Newsletter

Click Here

Posted: March 21, 2013

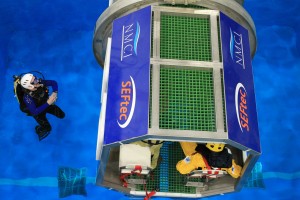

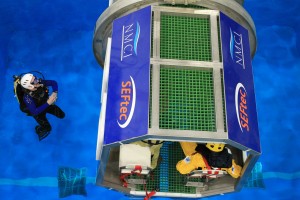

On 14 March 2013, His Excellency Sheikh Saoud bin Abdulrahman Al-Thani, Minister of Sport & Secretary General of the Qatar Olympic Committee (QOC) is pictured with Board Members of SEFtec NMCI Offshore (“SNO”), Conor Mowlds (pictured 2nd from left) and Darren O’Sullivan (pictured 4th from left). This was taken prior to the signing of a Memorandum of Understanding between SEFtec NMCI Offshore and IRM Offshore to provide support for the development of dedicated TEMPSC coxswain training facility in Qatar over the next 12 months.

On 14 March 2013, His Excellency Sheikh Saoud bin Abdulrahman Al-Thani, Minister of Sport & Secretary General of the Qatar Olympic Committee (QOC) is pictured with Board Members of SEFtec NMCI Offshore (“SNO”), Conor Mowlds (pictured 2nd from left) and Darren O’Sullivan (pictured 4th from left). This was taken prior to the signing of a Memorandum of Understanding between SEFtec NMCI Offshore and IRM Offshore to provide support for the development of dedicated TEMPSC coxswain training facility in Qatar over the next 12 months.

Sign Up to our Newsletter

Click Here

Posted: March 20, 2013

The Irish Examiner

Wednesday, March 20, 2013

Fastnet Oil & Gas has initiated a farm-out process to help cover the cost of its forthcoming $18m (€14m) surveying activity in the Celtic Sea, which will be the biggest of its kind ever undertaken in the area.

Last month, the exploration firm selected French geophysical specialist, CGG to carry out the 3D seismic survey to cover 2,200sq km of the Celtic Sea.

Fastnet say the 3D survey will last for about 50 days. It is due to begin in April.

The firm had been expected to partially pay CGG from the €18.6m capital it raised late last year, but it has commenced a search for a partner who will stump up most of the cash in return for a stake in one of the licence areas being surveyed.

The survey will cover Fastnet’s ‘Mizzen’ prospect and adjoining areas — where several large structures have been identified — but will begin at the Deep Kinsale Prospect, in which Fastnet purchased a 60% stake last month.

The prospect is a potential oil-bearing reservoir situated underneath the Kinsale Gas Field. The potential to expand the 3D study exists, but depends on interest from potential partners.

Paul Griffiths, Fastnet’s managing director, said that even at this early stage, the company is “very encouraged” by the level of interest being shown, “by a broad spectrum of companies”.

“This is the first large-scale 3D seismic programme to be acquired in this part of offshore Ireland. Whilst we are targeting proven hydrocarbon systems around the Kinsale and Barryroe fields, we are also evaluating a prospective part of the Celtic Sea Basin, covering approximately 4,250 sq km, that has seen only one well drilled, in 1975 by Esso, which encountered oil shows. 3D seismic is the first step to creating material, ‘drill ready’ prospects.”

By Geoff Percival

http://www.irishexaminer.com/business/fastnet-looks-for-farm-out-partner-225926.html

Sign Up to our Newsletter

Click Here

Connect with NMCIS