Training – A delegates perspective

As with most of our blog posts lately we like to start with a quote. Just a little something to keep in mind while reading our blogs. So we have decided that for this blog our quote should be “Safety isn’t just a slogan, it’s a way of life”. Those few words explain just how our instructors work. Safety for our instructors is not just a slogan; it really is a way of life.

Who am I?

Before anybody goes offshore there are a number of courses which they must complete, depending on their role in the oil & gas sector, with a MIST, BOSIET and HUET being the basic requirement.

Seen as I’m the new marketing executive for NMCI Services I decided it was time for me to take the plunge and complete one of the many offshore courses we offer through S.N.O (SEFtec NMCI Offshore). When people read blogs they want to read about peoples personal experiences and know what exactly happens when a delegate arrives to do a course. So on Thursday March 12th I had the opportunity to be a delegate on a HUET Course.

My day as a delegate

As I’m an employee things were a little different. I didn’t have to arrive in reception at 8.45 am or I didn’t have to find my way or travel from a neighbouring country. So I was going doing the meet and greet at 1:30pm.

After the theoretical aspects of the course were completed it was time to get into the water. Before a delegate can get into the water you have to don your swimwear and a tracksuit and t-shirt. The instructor will then give you a pair of overalls and a transit suit. I have to admit this is a bit strange because you feel like you’re in a blow up boiler suit. Once the shoes are on then it’s time to put on your life jacket.

What happened…

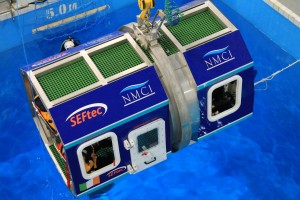

After a safety briefing pool side it was time to get into the water in our environmental pool. The temperature is kept at 21 degrees so it wasn’t cold like I had expected. It was hard to stay up in the water as at no point in our pool can you stand up. This is to help simulate the idea of being in the ocean. When you’re in the suit you have to swim backwards to stay afloat and then make your way over to the unit. Out unit is manufactured by SEFtec.

Once in the unit the instructor once again goes through what is going to happen. You are so well briefed that the idea of being underwater without air doesn’t seem so terrifying. There were 2 divers and then 2 instructors pool side. Safety is paramount when it comes to any course but for somebody who wouldn’t exactly be a water baby I definitely felt safe in the hands of all the instructors.

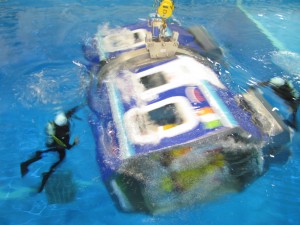

I will admit I was a bit nervous once the 3 safety checks had been done and the briefing had been completed. Before completing the first exercise we once again completed the 3 safety checks and went into the brace position. Once the unit hit the water it was time to pull the emergency strap on the window and once the water reached chest level it was time to take that big breath of air. Depending on which side of the ditcher unit you are in you have one hand on the window and the other on your buckle. This helps ensure that you are in a position to release the buckle and to push the window out so you can easily remove yourself from the unit. The first time the unit was submerged I found I was able to hold my breath but then again I did probably get out too fast. Second time around I was more psyched up to do it and the instructors helped calm me and motivate me to complete the training. Safety checks were completed again, brace position, pull the latch, take a deep breath and then once the unit has stopped moving unbuckle and remove yourself through the window. I didn’t seem to follow the steps and when I went to unbuckle I didn’t fully twist the buckle to unlock it. This meant I was stuck. Like I previously mentioned I’m not exactly a water baby so my immediate response was to panic. The instructors and divers are on high alert and noticed straight away and released me from behind my seat. Once I reached the surface I was perfect but I had gotten a bit of a shock. Third time lucky right? Well that did work. On my third attempt I completed each of the steps. This time I even decided to stay in the unit just a while longer as I wasn’t sure if it had stopped moving. Then once I did get out I was ready to take on the “capsize” aspect of the training.

The adrenaline was obviously present at this stage because I was a nervous wreck the night before thinking about it and then I was all go. I returned to the unit and once again strapped in and completed the safety briefing then the safety checks. I was fortunate enough to do the capsize without the window in the unit, don’t know if I would even have the strength to push out the window. The unit was being submerged in the water, I placed my right hand on the window frame tightly and placed my left hand on my buckle. Once we were completely submerged and the unit began to capsize the force of water wasn’t what I was expected and I lost my grip on the windows edge which did frighten me. I had my eyes open which meant I could see everything moving really fast. I would definitely recommend delegates to keep their eyes closed if possible as it’s hard to adapt to the change in surroundings when you’re capsizing.

Overall experience

The instructors and divers really made me feel comfortable in the water. It’s not an easy task completing any training but knowing you have people, for whom safety is a way of life, by your side definitely helps you relax. From the moment I walked up the stairs to the pool to the moment I got out of the environmental pool I felt like I was in safe hands. Everything is explained numerous times and they ask questions to ensure you are comfortable. For me, even climbing up a ladder is terrifying, so knowing that I was able to complete a HUET, I can safely say it was down to the team of people who were there on the day. For some delegates it can be extremely challenging to complete courses and I can now understand the nerves they develop, but I was the same and the team here at SEFtec NMCI Offshore helped me to face my fears. If I can do it then you can too…

Thanks for an amazing afternoon Joey, Terry, Cillian & Melissa.

Sign Up to our Newsletter

Connect with NMCIS